-

Transnet loses third court battle and ordered to pay R60m to Gijima

Transnet loses third court battle and ordered to pay R60m to Gijima

-

UMP’s ambition to position SA as a leading rice exporter

UMP’s ambition to position SA as a leading rice exporter

-

Polokwane mayor’s gobbledygook on R41.2 million refund to developer

Polokwane mayor’s gobbledygook on R41.2 million refund to developer

-

Transnet’s loses yet another application to push Gijima Holding’s from IT contract

Transnet’s loses yet another application to push Gijima Holding’s from IT contract

-

Fetakgomo Tubatse municipality dumps consultants and still keeps a good financial record

Fetakgomo Tubatse municipality dumps consultants and still keeps a good financial record

-

Limpopo government finishes sixth traditional office in 2025/26

Limpopo government finishes sixth traditional office in 2025/26

-

Masoga approaches High Court to clear his name on allegations of corruption at MMSEZ

Masoga approaches High Court to clear his name on allegations of corruption at MMSEZ

-

Municipal manager’s bid to attach CFO’s pension fails

Municipal manager’s bid to attach CFO’s pension fails

-

Visit Limpopo Ka Dezemba – Premier Ramathuba

Visit Limpopo Ka Dezemba – Premier Ramathuba

-

‘Sacking of our Mpumalanga chairperson is a rumour’ – SACP

‘Sacking of our Mpumalanga chairperson is a rumour’ – SACP

SA needs R499bn annually to achieve its climate change targets

Sizwe sama Yende

South Africa finds itself unable to increase climate change adaptation finance due to its debt on the Gross Domestic Product being 74% and servicing debt consuming 20% of the country’s expenditure.

Adaptation finance enables countries to prepare for climate change risks by, for example, building climate-resilient infrastructure to withstand extreme weather conditions such as floods.

According to the UN, a staggering 3.6 billion peoples — nearly half of the global population — are currently highly vulnerable to climate change impacts.

Other risks countries need to prepare for and put adaptation measures in place include storms, heat stress and food insecurity.

This finance also covers water management, climate smart agriculture initiatives that can continue to produce food when droughts and floods hit. It further goes to health, education, and biodiversity to ensure that societies are prepared and resilient.

The South African Climate Finance Landscape 2025, compiled by the presidential Climate Policy Initiative, notes that 11.3% of tracked climate change finance supported adaptation. This figure is far less than the Africa average of 33.7%.

“Adaptation projects often generate public benefits such as enhanced resilience and reduced vulnerability to climate risks, but typically lack clear revenue streams. This limits their attractiveness to private capital,” notes the report.

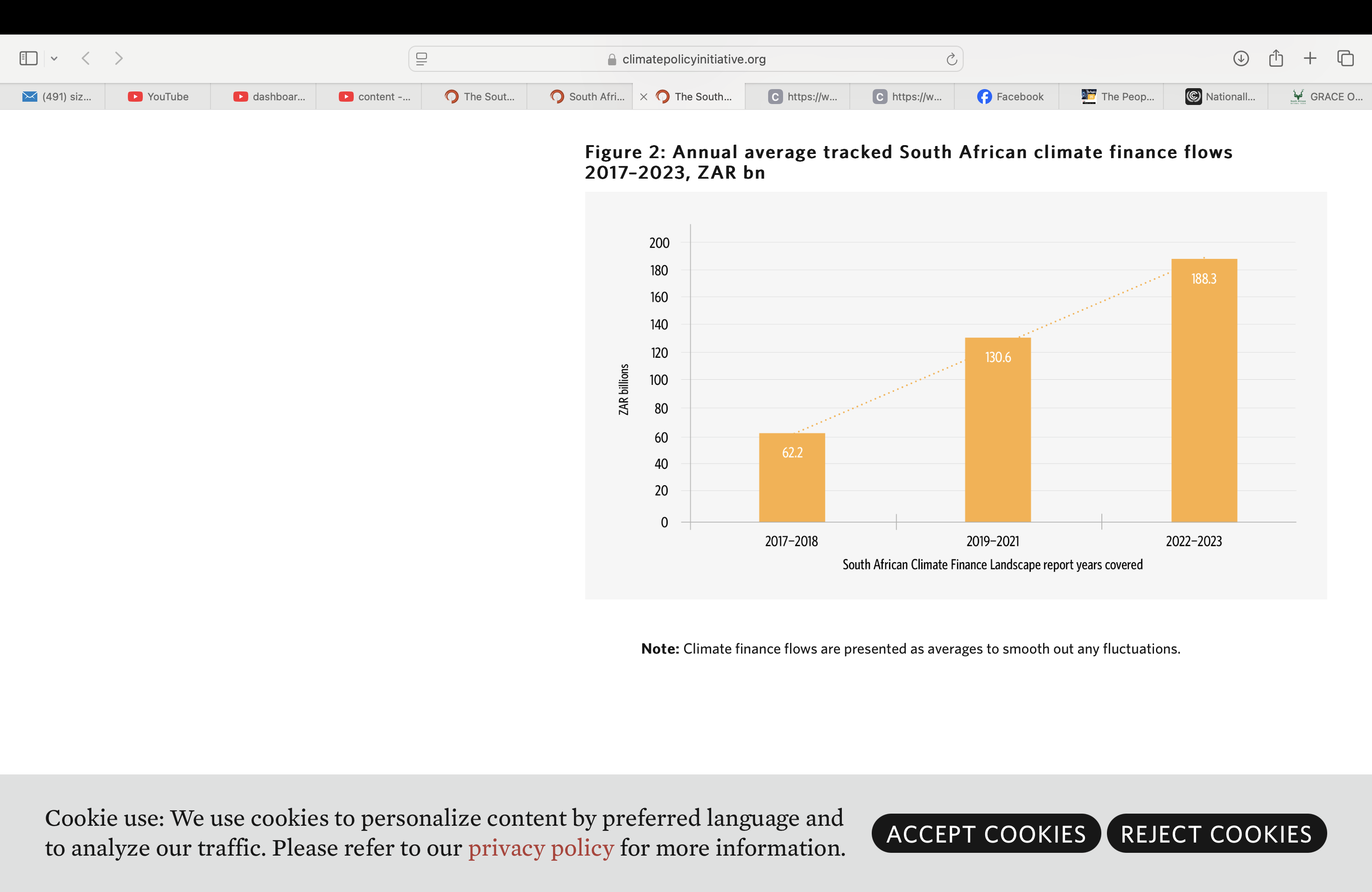

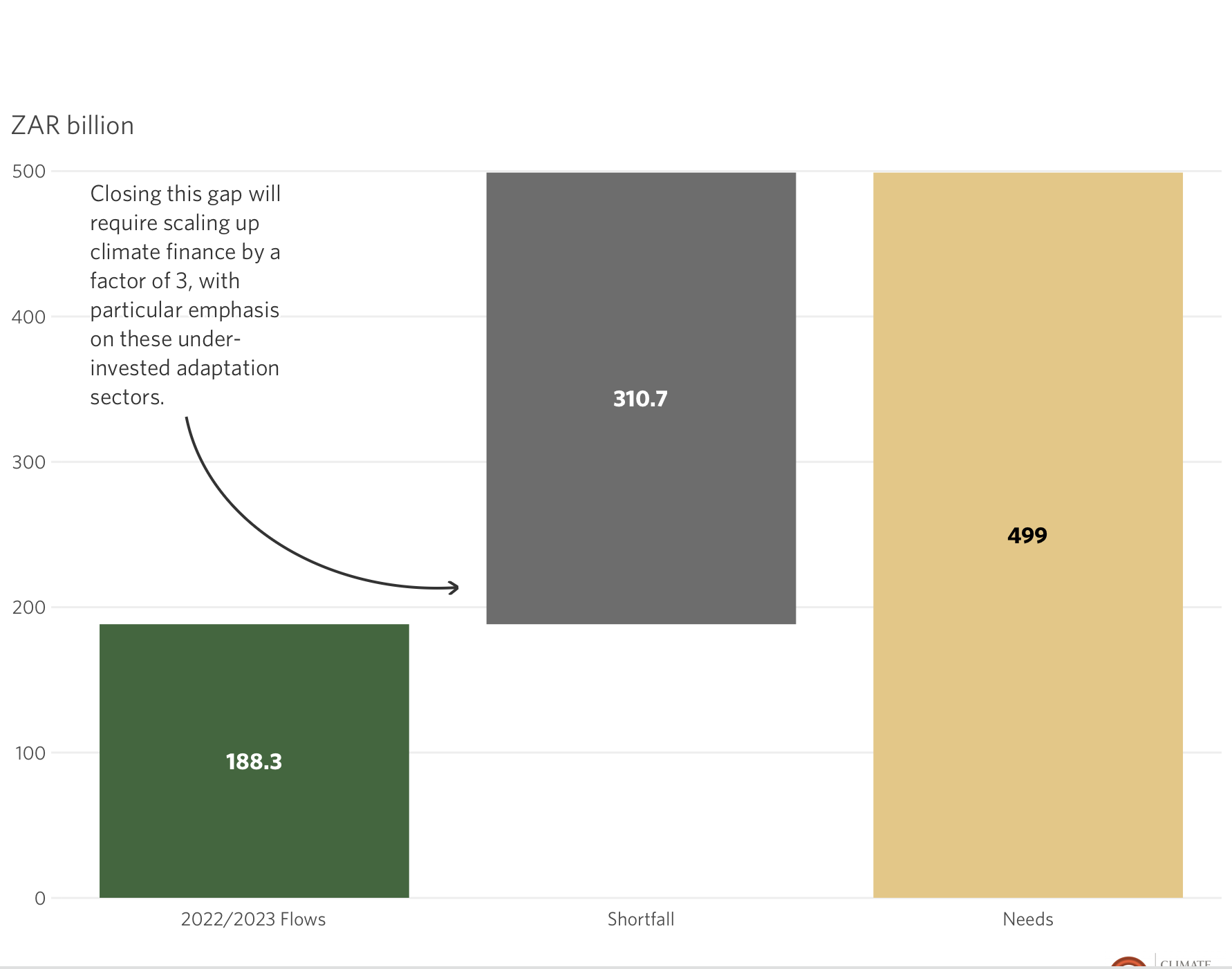

The key finding was that South Africa’s climate finance needed to be tripled for the country to meets Nationally Determined Contributions (NDC) - efforts to reduce carbon emissions and adapt to climate change impacts - and net-zero targets.

The study tracked R188.3 billion of climate finance used in 2022 to 2023. It says that this amount will need to be increased to R499 billion annually to enable the country to achieve its NDC goals.

“South Africa is mobilising climate finance at scale, but current flows are below need.”

Energy dominated climate finance, the study found, as R139.5 billion on average annually, went into renewable energy. This has been attributed to load shedding, which saw more investment going to solar photovoltaics, wind power and battery storage.

According to the study, nearly 60% of climate finance flows originated from local commercial banks (R36.6bn), corporates (R28.4bn) and households (R15.2bn).

Public sources dominated international climate change finance flows with R58.3 bn in contributions. The money came from Development Finance Institutions (DFI), multilateral DFIs, foreign governments and multi-lateral climate funds.

“International finance was primarily channeled through market-rate debt (37.9%), equity (20.1%), concessional debt (20.8%), and grants (15.9%),” the report found.

“The majority of international climate finance flows originated from Western Europe (71.2%), primarily reflecting commitments from the International Partners Group (IPG) under the JETP established in 2021.”

This happened despite the United States’ withdrawal from the IPG and the associated JETP in early 2025.

Cross-cutting challenges, the report said, continued to constrain outcomes. “Grid bottlenecks in high-resource provinces restrict renewable rollout. Policy fragmentation, such as delays in updating the Integrated Resource Plan (IRP) and uneven municipal permitting processes, creates uncertainty. Weak GDP growth and rising borrowing costs limit fiscal space and investor confidence for climate finance,” the report said.

Following two weeks of intense negotiations at COP 30 in Belem, Brazil, delegates adopted text calls for mobilising at least $1.3 trillion per year by 2035 for climate action, alongside tripling adaptation finance and operationalising the loss and damage fund agreed at COP28.

They specifically committed to double adaptation finance by 2025 and triple it by 2035.